529 Yearly Contribution Limit 2024. In 2024, 401(k)s max out at $23,000 for savers under 50 and $30,500 for those 50 and over. The beneficiary of both the 529 account and the roth ira must be the same person.

Here is what you need. In 2024, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709.

The Beneficiary Of Both The 529 Account And The Roth Ira Must Be The Same Person.

2024 has brought new rules for 529 college savings accounts, including the ability to roll over funds to a roth ira without taxes or penalties.

In 2024, 401(K)S Max Out At $23,000 For Savers Under 50 And $30,500 For Those 50 And Over.

Starting in 2024 — thanks to “ secure 2.0 ,” a slew of measures affecting retirement savers — families can roll unused money from 529 plans over to roth.

The 2024 Application Period Is Now Open Until 11:59 P.m.

As of 2024, up to $18,000 per donor per beneficiary ($17,000 in 2023) qualifies for the annual gift tax exclusion.

Images References :

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

529 Plan Contribution Limits For 2023 And 2024, In 2024, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709. In my home state of iowa, parents (or other 529 account owners, like grandparents) can deduct 529 contributions of up to $4,028 from their iowa adjusted.

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg) Source: www.investopedia.com

Source: www.investopedia.com

529 Plan Contribution Limits in 2024, Annual rollovers are subject to yearly ira contribution. Most states do set 529 max contribution limits somewhere between $235,000 and $529,000.

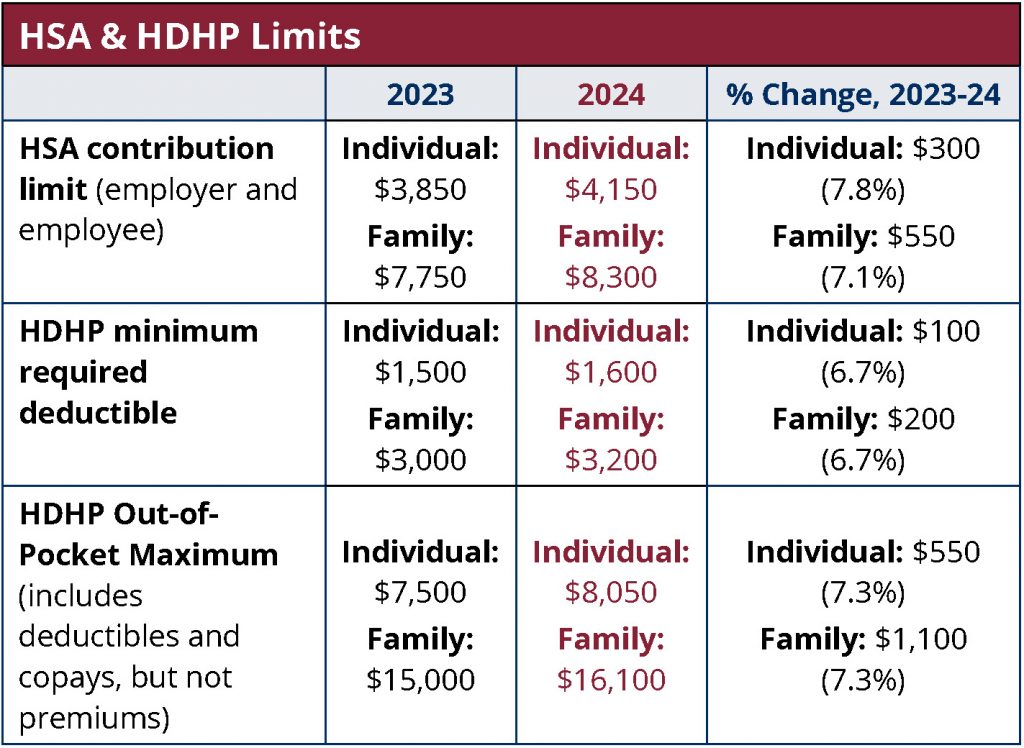

Source: www.medben.com

Source: www.medben.com

2024 HSA Contribution Limit Jumps Nearly 8 MedBen, In my home state of iowa, parents (or other 529 account owners, like grandparents) can deduct 529 contributions of up to $4,028 from their iowa adjusted. There is no annual limit on contributions to california 529 plans, but contributions in excess of the annual gift tax exclusion of $16,000 per beneficiary.

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits Rise In 2023 YouTube, The amount of the rollover is limited: In my home state of iowa, parents (or other 529 account owners, like grandparents) can deduct 529 contributions of up to $4,028 from their iowa adjusted.

Source: districtcapitalmanagement.com

Source: districtcapitalmanagement.com

The Complete Guide To Virginia 529 Plans For 2024, $4,000 per beneficiary for single filers or married filing joint, or $2,000 per beneficiary for married filing separate and certain divorced parents of a. However, at high income levels,.

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits (How Much Can You Contribute Every Year, In 2024, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709. Here is what you need.

Source: www.forbes.com

Source: www.forbes.com

529 Plan Maximum Contribution Limits By State Forbes Advisor, The ira contribution limits for 2023 are $6,500 for those under age 50 and $7,500 for those 50 and older. 529 college savings plans do not have contribution deadlines.

Source: atonce.com

Source: atonce.com

50 Unbelievable Benefits of a 529 Plan Ultimate Guide 2024, The amount you can roll over from a 529 plan into a roth ira account is subject to the annual roth ira contribution limits set by the irs. Annual rollovers are subject to yearly ira contribution.

Source: matricbseb.com

Source: matricbseb.com

529 Contribution Limits 2024 All you need to know about Max 529, For 2024, the ira contribution limits are $7,000 for those. 529 plans do not have an annual contribution limit.

Source: peaceofmindinvesting.com

Source: peaceofmindinvesting.com

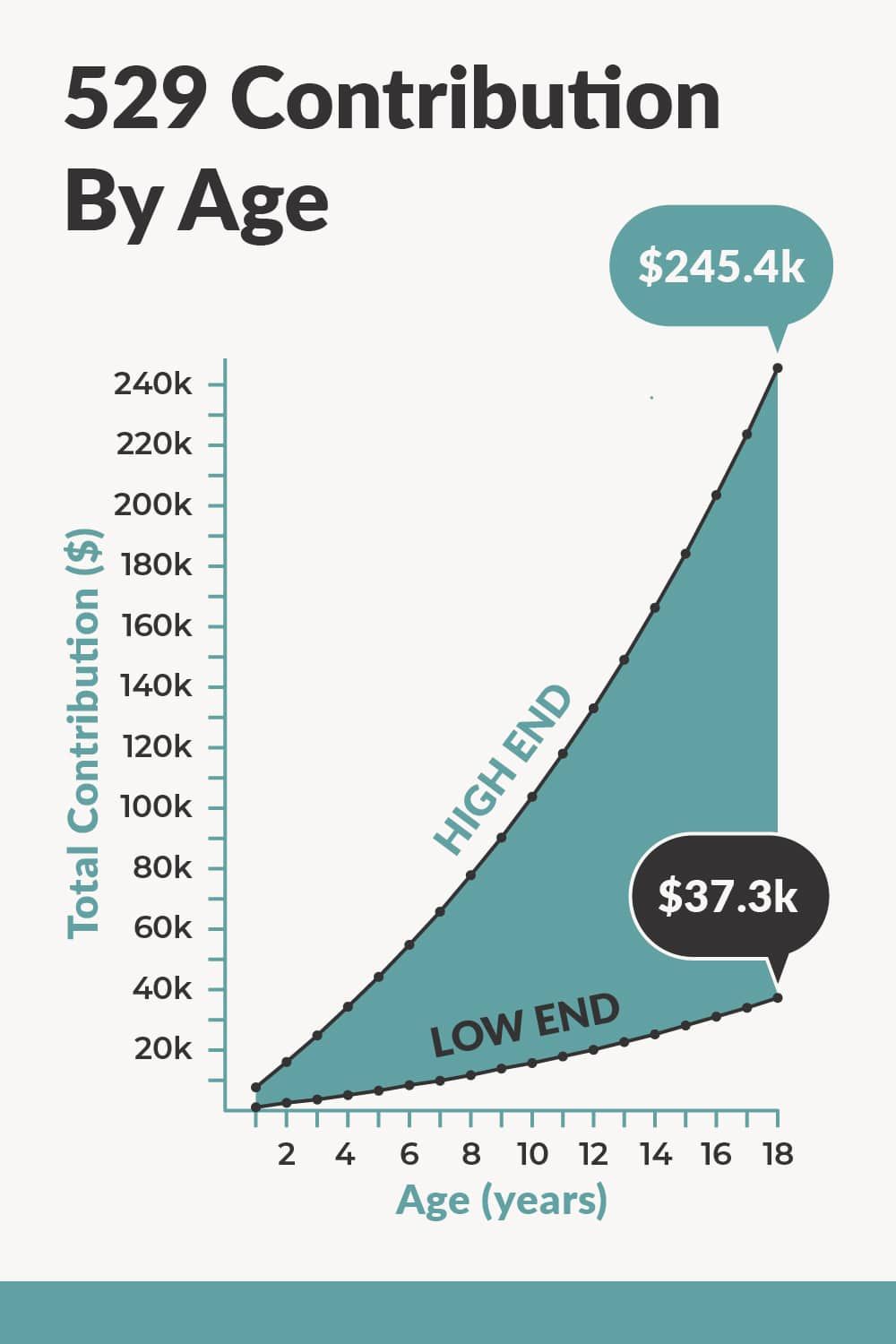

What Should you have in a 529 plan based on your age?, Maximum aggregate plan contribution limits range from $235,000 to $529,000 (depending on the state), but such limits generally do not apply across states. Unlike retirement accounts , the irs does not impose annual contribution limits on 529 plans.

529 Plans Do Not Have An Annual Contribution Limit.

As of 2024, up to $18,000 per donor per beneficiary ($17,000 in 2023) qualifies for the annual gift tax exclusion.

Taxpayers Must Report Excess Contributions Above $18,000 On.

However, at high income levels,.

Maximum Aggregate Plan Contribution Limits Range From $235,000 To $529,000 (Depending On The State), But Such Limits Generally Do Not Apply Across States.

For 2024, the ira contribution limits are $7,000 for those.

Category: 2024